Not only can a long term care insurance (LTCI) policy protect your retirement savings and your peace of mind, it can also save you money with tax breaks and incentives. If you have been on the fence about purchasing a policy, take a look at the potential savings below, and check out our updated 2022 Tax Guide.

Individuals can Deduct their Premiums

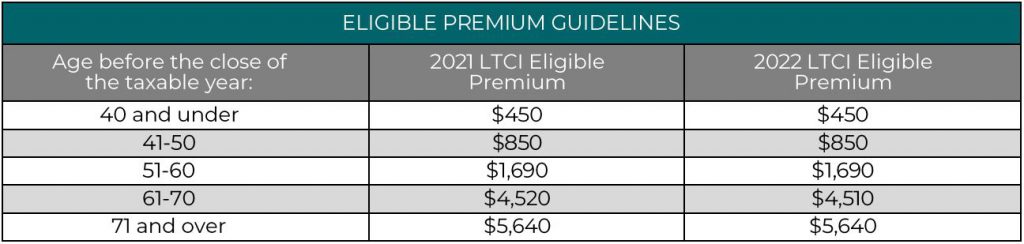

Current tax laws allow for the deduction of either the actual premium or the eligible premium paid on a tax-qualified LTCI policy.1

- Actual premium is the actual amount of premium paid

- Eligible premium is an amount determined annually by the federal government based on the medical care components of the Consumer Price Index and the age of the policyholder

If your combined medical expenses (tax-qualified LTCI and other medical expenses) exceed 7.5% of your Adjusted Gross Income (AGI), you may be eligible for a deduction. Any portion of LTCI premiums outside of the eligible premiums listed below cannot be includable as a medical expense.2

Use Alternate Payment Methods to Save More Money

Did you know that you can use your Health Savings Account to pay a portion of eligible LTCI premiums with tax-free money in your account? The amount you can withdraw is based on your age up to annual IRS limits. You can also withdraw the above limits for your spouse’s coverage.

If your employer offers a high deductible health plan with HSA, consider your options. HSAs can be a great way to save for current and future eligible health care expenses, including a portion of LTCI premiums now and into retirement. For more information about HSAs and limitations, review IRS Publication 969.

Pay Policy Premiums with an Annuity Tax-Free Transfer

If you have an annuity, you can transfer money tax-free to pay for LTCI premiums or transfer funds to another annuity with an LTC rider. This transfer is referred to as a 1035 exchange. Funds must be directly transferred from an annuity to pay for premiums to enjoy the benefits of the tax-free transfer. If you withdraw money from the account to pay premiums, you will be required to pay income taxes on gains. Your LTCI carrier can help with 1035 exchange for tax-free transfers.

Use your Permanent Life Insurance for a Tax-Free Transfer

Another tax-free exchange option is by using a cash-value Life insurance policy to pay for LTCI premiums or transferring to a hybrid Life insurance policy with LTC rider. The tax-free funds come from the policy’s cash value or policy dividends. This can be a great option as you get older and don’t need as much Life insurance coverage.

Your LTCI Benefits are Intended to be Tax-Free

As long as the benefits you receive from your tax-qualified LTCI policy do not exceed the greater of your qualified long term care (LTC) daily expenses or the per-day limitation of $390 (2022 limit), your benefits should be tax-free.3 The IRS treats your LTCI benefits much like reimbursements for medical expenses, which they don’t consider taxable income.

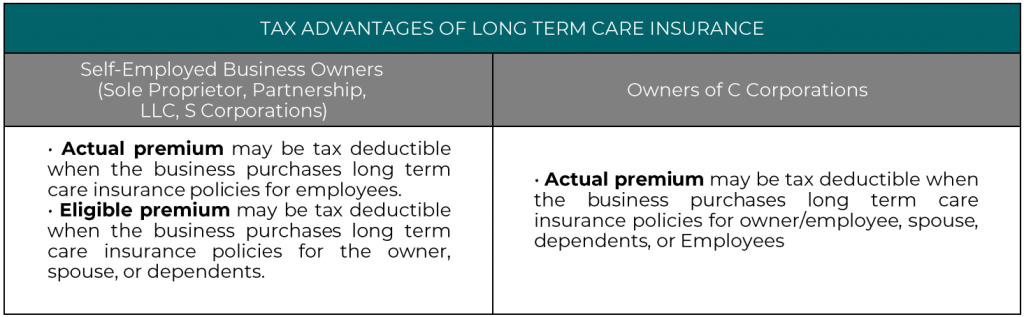

Business Owners can Save Money too

Depending on the tax structure of your business, there may be significant tax savings when you use business dollars to purchase LTCI.

Partnership Policies Provide Additional Protections

Partnership policies are tax-qualified plans that, by federal law, contain certain consumer protections and must provide inflation protection benefits for purchasers so that benefits keep up with the cost of inflation over time. The LTC partnership program provides an alternative to spending down or transferring benefits by forming a partnership between Medicaid and private LTC insurers. Once private insurance benefits are used, special Medicaid eligibility rules are applied if additional coverage is necessary. This is to help incentivize the purchase of LTCI.

Partnership policies have certain requirements so not all states offer them. Please check with your state department of insurance or review our map to see if your state has a plan available. Please also note that special agent training is required to sell partnership qualified plans, so it is important to speak to a LTC specialist when considering the purchase of LTCI.

LTCI Specialists Break Down Complicated Tax Information

If you have further questions about protecting your family with a tax-qualified LTCI policy, reach out to one of our specialists today. They can answer all your questions, offer you several suggestions based on years of experience, and put your mind at ease that you are making the best decision.

Disclaimer: This blog post does not constitute legal or tax advice and should not be construed as tax or insurance advice. It was neither written nor intended for use by any taxpayer for the purpose of avoiding penalties, and it cannot be so used. Please speak with your tax advisor or LTCI specialist regarding a particular situation.

1A tax-qualified policy is based on the guidelines defined by the Health Insurance Portability and Accountability Act of 1996 (HIPAA).

2Allowable deductions are set by IRS Revenue Procedure 2021-45.

3The 2022 per diem limitation for tax-free benefits is set by Section 7702B of the Internal Revenue Code (IRC).

You must be logged in to post a comment.