Washington Care Funds

01

What

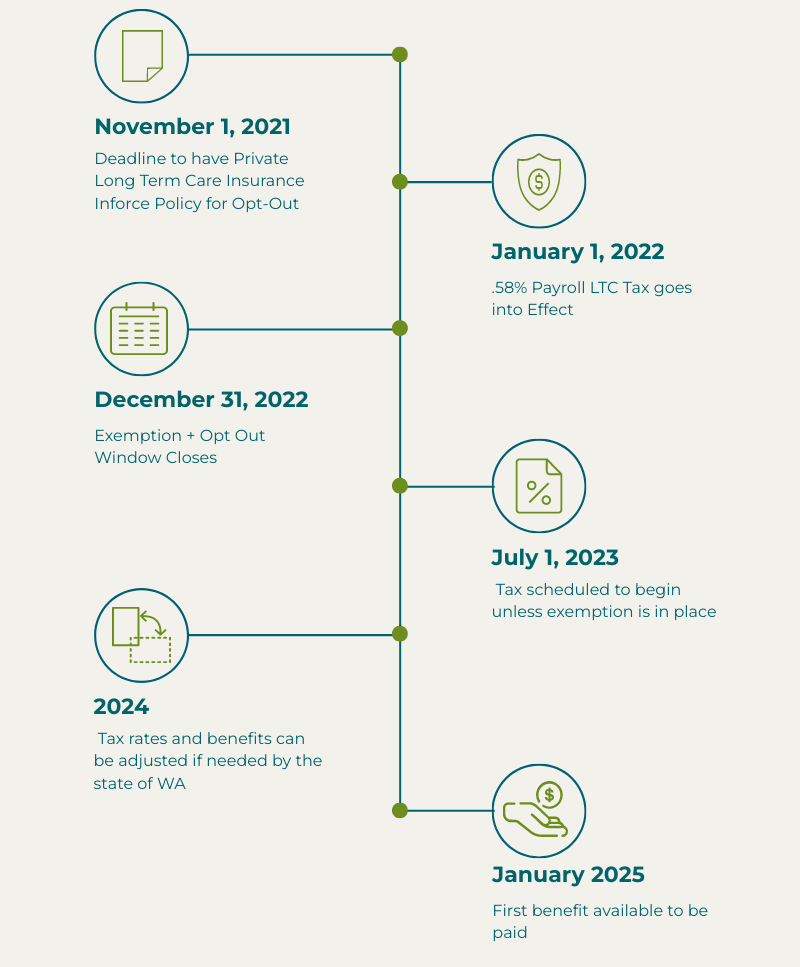

The Washington State Payroll Tax is the state’s solution to the rising costs of long-term care. Washington is the first state in the US to implement this tax. It is set to be funded by 0.58% of all employee wages and goes in force January 1, 2022. As of December 17, 2021 there has been a pause to not collect the premiums from this program from employers before they come due in April. During the pause, employers won't incur penalties or interest for not withholding those taxes from worker wages.

Unlike many other state sanctioned insurance programs, the contributions per employee are uncapped. For example, an individual who earns $180,000 a year will pay $1,044 and a person who earns $70,000 will pay $406. All forms of compensation including stock, bonuses, paid time off, and severance are subject to the tax.

02

Who

The long-term care benefits of this tax are payable only once an employee has paid the premiums for a total of 10 years without a five-year consecutive break. After they have done this they are permanently vested and will have the benefits for life. They can also pay three years within the last six years from the date of application to be temporarily vested. Temporary vesting will un-vest after a set amount of time. This means that those who are planning on retiring in the next 10 years are at risk of paying premiums for an insurance they may never qualify for. Those who reside in Washington and decide to move out of state after retiring will not be eligible for any benefits.

03

Benefits

If one cannot complete three of 10 activities of daily living, or ADLs, the program will provide $100 a day with a lifetime limit of $36,500. Benefits will become available January 1, 2025.

According to the actuarial firm hired by the state to review the program, approximately 45% of residents could receive the same coverage on the private market for equal or lesser money. This statistic only considers the actual money, not the benefits that come along with private insurance such as portability outside Washington, better inflation protection, ability to cover partners and spouses, and coverage outside the United States. The way the bill was written also allows the tax amount to change every two years starting in 2024. The 0.58% that is being established could - and very likely will - rise as soon as is eligible.

04

Opt Out + Exemptions

There are 5 groups who can opt out of the program. For each category an exemption letter from WA Cares Fund is still required to provide their employer to opt out of the tax.

- WA residents who applied for and received their exemption from the tax because they have LTC insurance inforce. Exemption applications were due by 12/31/22 and now exemptions for this are no longer given.

- WA Residents who are 70%+ disabled as a veteran

- WA Residents who are spouses of active-duty military

- WA Residents with non-immigration temporary work visas

- Non WA residents

You must have another long-term care insurance policy in force by November 1, 2021. Those who do have a policy in force by the deadline must submit applications for exemption to the state. These will be accepted starting October 1, 2021 and will go until December 31, 2022.The tax goes into effect 1/1/2022, so if you have purchased a privatized long-term care insurance policy and wait until the end of 2022 to submit your application for exemption, you will be effectively “double-dipping” in payments. These payments made to the state are non-refundable.

Other exemptions include those who are: self-employed, employees of a federally recognized tribe, or collectively bargained employees who had contracts in force before October 19, 2017.

Yes. The WA Cares Fund has said that it intends to require individuals who have received an exemption from the fund to reapply for that exemption every three years or so. If an individual's exemption status changes, they have 90 days to report that change to the WA Cares Fund to avoid penalties and paying back taxes.

For example, if a Washington resident has long-term care insurance in force and has received an exemption from the WA Cares Fund, but later cancels their coverage, they must report the cancellation to the fund within 90 days to avoid additional penalties, including paying all the taxes owed.

05

Additional Resources

If you’d like to get additional coverage to have a more robust long term care plan, please feel free to reach out to us. A lot of long term care insurance companies paused sales in the state of WA. As more insurance companies re-enter the state of WA, we can help you with more customized plans. Request a quote now.

Recommended Reading

Most states offer LTC government programs with incentives for those who buy LTC insurance.

Long term care insurance premium increases have recently been in the news.

Have you considered making a strategy to prepare for an unexpected long term care event?

You must be logged in to post a comment.