As the saying goes, “What’s mine is yours.” And in the case of sharing long term care insurance coverage, that can be true!

One concern you may have as you research long term care insurance is what happens if you never use it. If you are purchasing insurance with your spouse, then an option would be to add a Shared Care feature, which allows the ‘What’s mine is yours’ phrase to be possible.

"It basically doubles the money you have access to."

As one of the most purchased add-ons to long term care insurance policies, it is important to understand why. This feature allows you to join (pool) you and your partner’s policies together. If one of you uses up all of your benefits, you have the ability to dip into your partner’s half. Any remaining benefits are still available to your spouse, or you may access the benefits until they are completely used up. This added feature allows you to get the most out of your policies by combining your benefits.

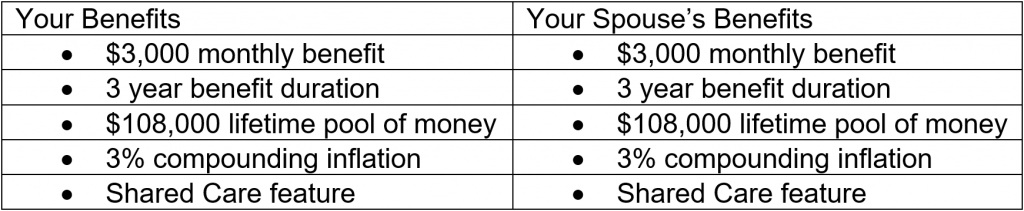

For the purpose of this example, let’s say you and your spouse are 50 years old, married, and applying together for long term care insurance. These are the benefits you apply for:

So what does that look like with the Shared Care feature?

- Your benefits will grow at 3% compounded each year

- By the time you are 80 years old, money will have grown to approximately $262,000 for each person or $524,000 together

- If one spouse dies suddenly, then the entire unused benefit is automatically transferred to the surviving spouse. There is no additional cost and the policy payments end for the decease spouse, further lowering the cost.

This may sound too good to be true, but it is not! In this example it is only an extra $10-$20/month to add the shared care feature and it basically doubles the money you have access to.

"This added feature allows you to get the most out of your policies by combining your benefits."

By applying with a spouse or partner you also are eligible for an extra discount ranging from 15-35% off your payments. In most states the discount is not only available to married spouses, but also any adult partners living together for a certain number of years.*

LTC Consumer is an independent, free online service to help consumers understand what long term care insurance is, how it works, and how to evaluate coverage options. Our mission is to provide an educational, no-pressure resource for learning about long term care planning, with the opportunity to speak with specialists who can help them.

*Qualifications vary by carrier.

You must be logged in to post a comment.