Sometimes the savings goals and planning requirements for retirement are intimidating, especially when you consider the odds of you or your partner requiring long term care. A healthy 65-year-old couple has a 75% chance that one partner will require a significant level of long term care if they each live to their projected actuarial life expectancies, according to a new HealthView Services report.

That’s why a US Representative out of Missouri, Eric Burlison, is proposing to make all long term care insurance premiums deductible. He says his bill will encourage individuals to purchase long term care insurance by providing a tax deduction for the costs of insurance premiums. Burlison states that the federal government should always be looking for ways to encourage individuals to be self-reliant instead of relying on government programs.

The bill is called H.R.8820 - Improving Access to Long-Term Care Insurance Act. It would essentially reduce other tax credits to fund a full long term care insurance premium tax deduction. Whereas previously individuals would have to include premiums with their itemized medical costs when they filed their federal income taxes.

Current Tax Laws and Long Term Care Insurance Premiums

Current tax laws allow for the deduction of either the actual premium or the eligible premium paid on a tax-qualified long term care insurance policy.

- Actual premium is the amount of premium paid

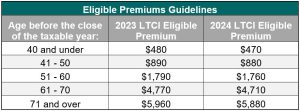

- Eligible premium is an amount determined annually by the federal government based on the medical care components of the Consumer Price Index and the age of the policyholder.

If your combined medical expenses (tax-qualified long term care insurance and other medical expenses) exceed 7.5% of your Adjusted Gross Income (AGI), you may be eligible for a deduction. Any portion of long term care insurance premiums outside of the eligible premiums listed below cannot be includable as a medical expense.

Once you go on claim, your benefits are intended to be tax-free. As long as your benefits you receive from your tax-qualified long term care insurance policy do not exceed the greater of your qualified long term care daily expenses or the per-day limitation of $410 (2024 limit), your benefits should be tax-free.

States Scrambling for Long Term Care Answers

In 2023 Washington created a new long term care insurance payroll tax. Those who have contributed may collect benefits as early as 2025. However, that tax is already being scrutinized and a new measure is slated for later this year to make the tax optional for everyone.

California, Massachusetts, and Minnesota are also researching similar programs, expanding Medicaid eligibility, reducing the costs of long term care insurance, and conducting studies for the best programs. It will be interesting to see what states follow suit.

One thing is for certain, the issue is not going away, and something must be done. If you or your loved ones are interested in exploring your long term care insurance options, get started today. You can receive a pre-recorded, education webinar, find out if you’re eligible after completing a health questionnaire, or connect with a long term care insurance specialist and get a free quote.

You must be logged in to post a comment.